I have been researching gold and silver miners for awhile now, but had not invested because there were just too many choices. I couldn't get a handle on them all, and I tend to examine the entire marketplace before plunging in. Hence, no positions.

Each prospect takes time to research, compare financials, resource reports, compare to market fundamentals, and against their competitors. But using a couple of methods, I have finally narrowed my picks to three which I present here. These may be different from your top three, and that is fine because in this segment of the market there will be many winners as fundamentals of gold and silver are bullish.

Before I get into the picks, I'll discuss my research methods a bit. One of the best decisons I made was to attend the San Fransisco Hard Assets Conference, where I found quite a bit of useful information.

What the San Francisco Hard Assets Conference did for me was introduce me to company executives who took the time to present their companies throughout the conference, and you could follow-up with them at their respective booth.

In addition, I was able to speak to industry experts during the conference, and attend break-out sessions for any expert I wished further instruction from. While each company is presented in their best light at the conference with warts hidden, the process still served to familiarize me with many potential companiesI had not heard of by researching online.

The best thing about the San Francisco Hard Assets Conference is that it was free to register. If you lived in the area, you had no cost to attend. I flew out from my perch in Texas and had to pay hotel costs, but even so I still consider it a tremendously price effective investment in my financial education. I expect the knowledge I gained to pay off many times over.

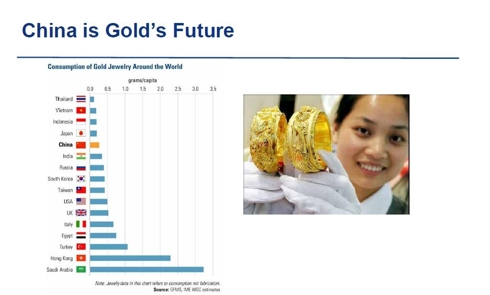

For example, Frank Holmes of U.S. Funds presented an interesting chart on consumption of gold jewelry by nation.

Click to enlarge charts

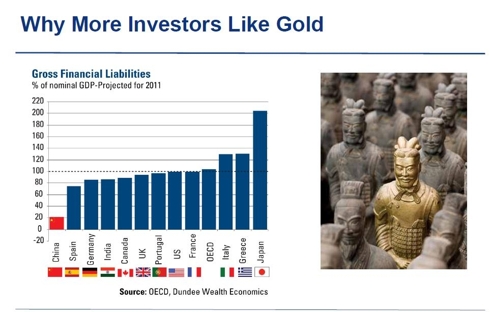

And a chart on gold as a global debt hedge.

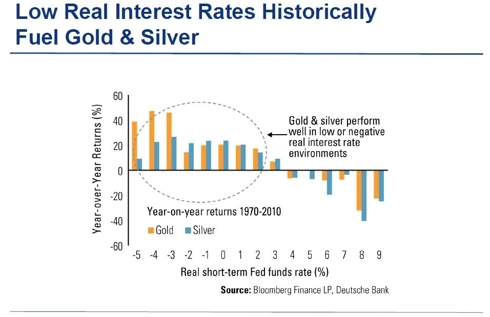

And how gold and silver perform during low real interest rate periods, such as we have now.

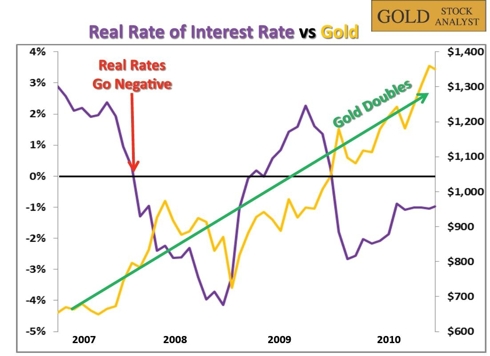

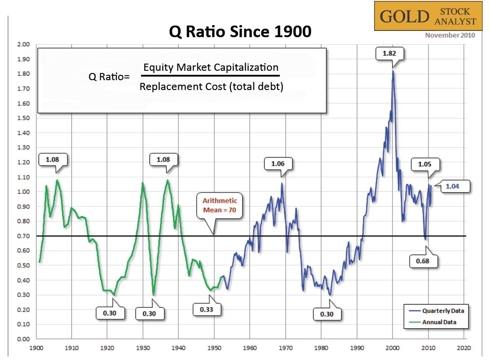

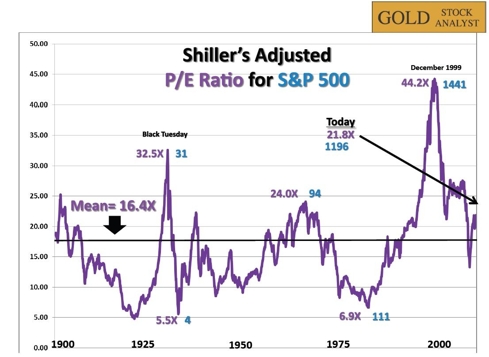

John Doody, Gold Stock Analyst, presented some interesting information as well.

The stock market, as a whole, is still above mean:

The trick then is to find individual stocks that outperform based upon value, and I think the commodity sector will lead the stock charge in 2011.

Periodic table of commodity returns, 2000-2009, from U.S. Funds.

Culling the Herd

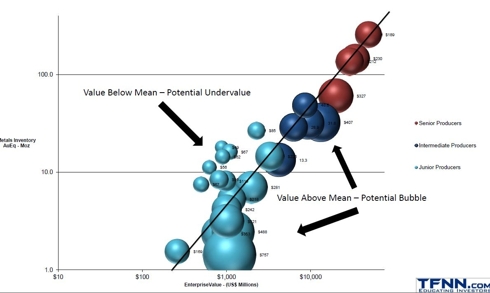

I picked up an enormously valuable research tool from Tom O'Brien during the San Francisco Hard Assets conference, where he gave a class and a general lecture. Tom breaks his analysis down into two metrics, MCVOMI and EVOMI, which you can research here.

MCVOMI = Market Cap Value / Metal Inventory, and measures the investor's total cost of the metals resource.

EVOMI = Enterprise Value / Metal Inventory, representing investor's cost minus working capital, plus debt against metals resource.

These two measures simplify financial analysis into two easy to understand standards that can value companies side by side. In fact, Tom has already done this for us on his website for a select group of companies.

In visual form, the analysis looks something like this:

Click to enlarge

You also see that Tom has broken the miners into segments Therefore, you can compare miners based upon their life stage, whether it is exploration, junior, middle tier, or mature producer.

That is a nice way to quickly narrow your search before you break out into full fledged analysis mode. I admit that without this tool, my research would have taken much longer and been more haphazard in nature.

Note that the tool is very handy but the pre-work is not done for you on every company. Therefore if your company is not on Tom's list, you can still apply the MCVOMI and EVOMI formulas to any miner you can find the financial data for to begin your analysis.

I like to stretch across segments to have both stability and potential, so I picked one exploration company, one mid-tier miner, and one mature miner for my portfolio.

Exploration Company

U.S. Gold (UXG)

This company is run by former Goldcorp founder Rob McEwen, who took Goldcorp to a $10 billion company. Superstar management is a big plus. U.S. Gold has projects in Gold Bar Nevada and El Gallo Mexico.

El Gallo is a near surface formation with existing infrastructure already in place. El Gallo contains 39.8 million measured silver ounces, and another 19.7 million potential. This year will see a feasibility study on this resource.

Gold Bar has a $40 million cost with expected payback in three years on a potential 60,000 ozs per year potential production where cost of production is $600 per oz, near about industry average. The pre-feasibility study will be conducted in 2011.

Total measured and indicated for the company is 3.3 million ounces gold and 41.1 million ounces silver. The company has no debt and 18.5 million in cash on 122 million shares and 8.8 million warrants. Throw in a very favorable MCVOMI and EVOMI financial measure relative to peers, and this company looks like a potential very solid exploration play.

Junior Producer

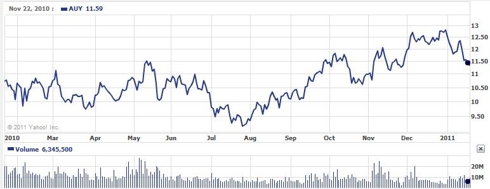

Yamana Gold (AUY)

Yamana has operations in Mexico and South America in proven metals districts, and has an excellent management team and board of directors running the company. Brazil and Chile make 75% of current production and are expected to make up to 85% of future production for the company. Many of the mines in production have expected lives between eight and 15 years.

Borrowing Kapitall's analysis of Yamana here at Seeking Alpha, we find the company is technically oversold. Price to sales ratio is very low compared to industry average, price to book is a third of industry average, cash flow is better than industry average, and the stock has seen a modest gain compared to its peers for 2010. This stock has not been run up as some others have been.

Click to enlarge

Analyst opinion is currently bullish on Yamana's prospects. In 2010 EPS was $0.38, an 85% increase from the previous year, a 45% boost in revenue year over year, 20% increase in operating cash flow year over year, and a 9.7% increase in gold ounce production. Copper sales increased from 31.6 to 43.5 million pounds in 2010. Company assets outweigh liabilities by a 3.9 ratio.

This company is financially solid, and as would be expected, the MCVOMI and EVOMI measures are much stronger than the peer group average.

Mature Miner

Newmont Mining Corporation (NEM)

Newmont had slightly higher gold production in 2010 than in 2009, and saw a 45% increase in copper production. Newmont has operations in Asia, North America, South America and Africa.

Click to enlarge

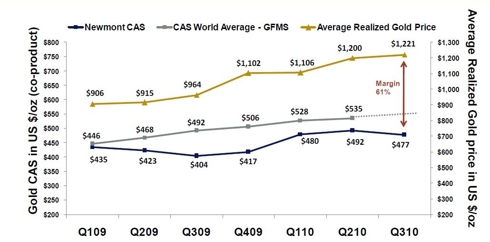

Gold and copper operating margins have risen for Newmont as they have for other industry peers. Given the bullish outlook for copper and gold in 2011, this should continue to add profitability to an already solid stock. We see that Newmont's operating margins beat its peers.

Click to enlarge

Newmont had record net income through Q3 of 2010, up 38% from previous year. Assets are 2.5x liabilities. Newmont has $6.1 billion available for development of assets. Motley Fool's analysis of Newmont's payout ratio shows that it is above industry peers.

Newmont made Kapitall's 10 most undervalued material sector stocks. If we expected Newmont to have a production shortfall, or expected the gold and copper markets to pull back strongly in 2011, this may be cause for concern. But based upon Newmont's resources and financial condition, I look at this as a positive for potential investors and not a negative.

The legitimate concern about a large cap gold producer is how long can the company continue to produce at the same level? There comes a point at which it is very difficult to maintain increasing production for large caps, as Minyanville notes.

For this reason, many analysts advise you stick with juniors in the metals markets to maximize value.

While realizing this risk, the flip side to the argument is that exploration and junior companies don't always pan out. Sometimes it is bad management, sometimes it is resource fields that don't match pre-assessment optimism, and sometimes companies simply run out of money in a capital intensive business model before they can ramp production. Investing in large caps offers both dividends and stability to a portfolio, much as in any stock sector.

And therefore I think the case can be made that Newmont, with lower operating costs, steady payouts, and better MCVOMI and EVOMI financial values than the peer group, is the best of the large cap stocks.

Disclosure: I own all three - UXG, AUY and NEM - as of this writing. I am long NEM, AUY, UXG.